Package "Entry"

Send and receive invoices, credit notes and other transaction documents more easily than ever before. Simplify your processes and save costs. Do your customers need standard data records such as ZUGFeRD or XRechnung? No problem with the functions of our “Entry” package.

Send and receive invoices electronically with our "Entry" package

• All transaction documents, such as invoices, credit notes, etc.

• Legally compliant and via standard channels

• In different standard formats, such as ZUGFeRD or XRechnung

• Protected against malware or phishing attacks

YOUR ADVANTAGES

Optimize your document exchange with our Entry Package

- efficient, secure and, of course, legally compliant!

THE GERMAN

E-INVOICING-OBLIGATION

The Germany-wide eInvoice obligation came into force on 1 January 2025. The acceptance of eInvoices that comply with the EN16931 standard has been obligatory for all German B2B transactions.

The previous preference for paper invoices is being phased out.

BECOME LEGALLY COMPLIANT

- In three simple steps -

1. Book a package

Book the “Entry” package directly and easily via our website.

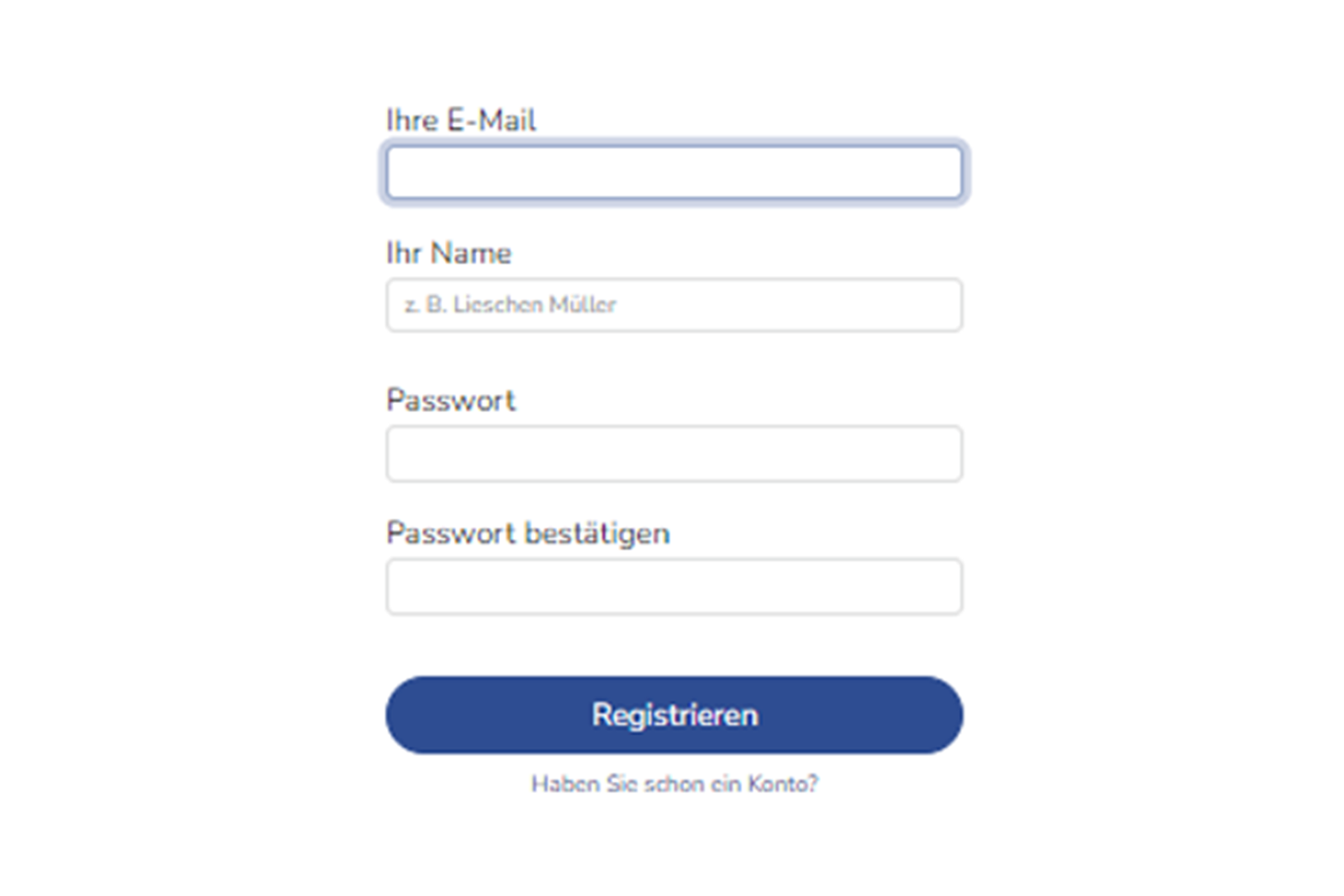

2. Register

Register using the invitation e-mail we send you with your desired e-mail address and password.

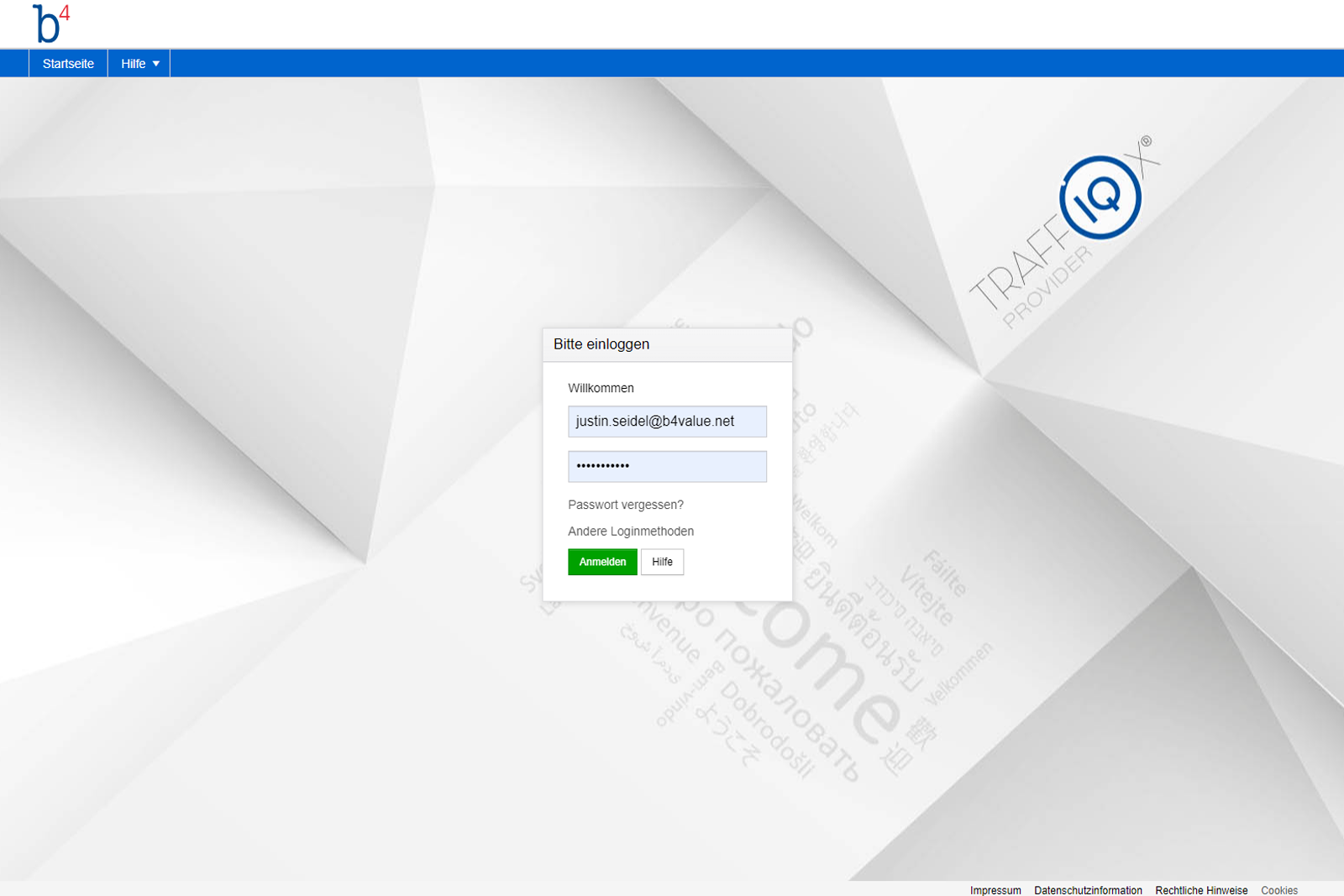

3. Send & receive directly

Log in to the b4 Business Portal and receive your invoices, credit notes and other transaction documents free of charge and in compliance with the law.

EXCERPT FROM OUR REFERENCE LIST

- These companies already rely on us and our expertise -

DO YOU HAVE ANY QUESTIONS?

- Simply book an information appointment -